Researching a bit on what’s driving our property taxes, I thought this info may be of help and interest. One of our highest priorities for the Legislature’s upcoming session will be to effectively tackle our rising property taxes. Background info how Natrona County builds its ‘wedding cake’ stack of tax mill levies and how to read the details of your own Notice of Assessment can be found here, as well as a breakdown of Natrona County levies here. Since the various mill levies have remained consistent for several years, there’s only one other component which is driving our property taxes higher, and that’s increasing property values.

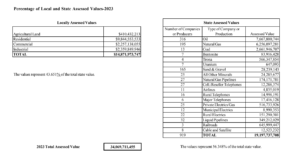

Let’s take a look then at property valuation trends. First, here’s the general breakdown between Local vs State assessed property values from the Wyoming Dept. of Revenue’s 2023 Annual Report. We’ll concentrate just on the Locally Assessed property to provide the detailed trends of both residential and commercial property values.

Below are two side-by-side charts showing how Locally Assessed property values have grown over the past few years. Interestingly, 2020 is an inflection point where so many various trends, including property values, begin their accelerating rise. Wyoming residential property grew nearly 10% from 2020 to 2021 (right hand chart), then grew over 20% from 2021 to 2022, and then grew yet another 20% from 2022 to ’23! OUCH!! That’s over 59% since 2020!! Residential property is not only the largest by far of the Locally Assessed group, it’s also the fasting growing. True – property values also contain new construction and home improvements which exacerbate the trends. But the pain experienced by rising residential property values is salient. Unfortunately, the inflation and whatever else is driving these values higher doesn’t appear to be letting up anytime soon. We need a structural change how we manage our residential property taxes, and that’s going to demand cooperation across the breadth of our Legislature and Governor.

Here are County-level residential property value growth rates since 2020. Lincoln and Teton Counties have experienced massive growth, almost doubling of property values in three years!

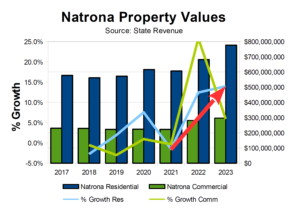

Here’s the Natrona County residential and commercial property value data. Our residential property values are growing relatively slow compared to the rest of the State, but nearly 15% growth for both ’22 and ’23 still is way too much!

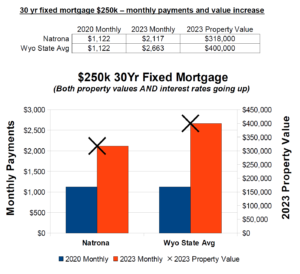

Someone tell me this doesn’t hurt and that the world outside Wyoming isn’t having a real and direct impact on all of us! 30yr fixed interest rates have doubled from 2020, 3.5% to 7%. Add to that the rocketing property values, then inflation for groceries, gas, utility bills etc. etc. Real pain we can’t ignore!